News

Save the Date – TRAS Fall Dinner, October 23, 2025

Join TRAS directors and friends at the Gurkha Himalayan Kitchen, 1141 Davie Street, Vancouver for an evening of conversation and great food.

Thursday, Oct 23, 2025

TRAS directors will share highlights and reports on current projects

Tickets can be purchased by credit card – phone 604-224-5133

or by e-transfer to info@tras.ca

Doors open at 6pm – Buffet Dinner at 7pm

Tea and Dessert to follow

No Host Bar

All proceeds will go to the CTA Tibetan Nurses Training

SPACE is LIMITED – BOOK NOW

Reservations will close Oct 18, 2025

Please do not contact the restaurant directly

63rd Annual General Meeting – September 10, 2025

TRAS held it’s 63rd Annual General Meeting via Zoom on September 10, 2025 at 7pm. Read the reports below.

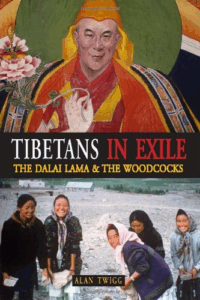

Congratulations to Vancouver author Alan Twigg

Established in 1989, the Order of B.C. recognizes individuals from all walks of life and fields of endeavour who have made extraordinary contributions to the province and beyond.

A long time friend of TRAS, author Alan Twigg, CM, Vancouver, has been invested into the Order of British Columbia, for his unparalleled contributions to B.C.’s literary landscape, championing writers, preserving stories and building the foundation of a thriving literary culture.

Alan has written over 20 books, including Tibetans in Exile: The Dalai Lama & The Woodcocks (Ronsdale, 2009), the amazing story of how George and Ingeborg while travelling in northern India in 1961 encountered many of the Tibetan refugees who had fled over the mountain passes. Appalled by the condition of the children huddled together with inadequate bedding, surviving on a diet of thin soup and momos, steamed dumplings of mixed wheat and corn flour, they expressed their desire to help. “You must absolutely come and see uncle,” said a young girl. This was Khando Yapshi, the Dalai Lama’s niece. Among the first Westerners to meet with the Dalai Lama, the Woodcocks vowed to provide humanitarian assistance. This was the genesis for the Tibetan Refugee Aid Society, now named Trans-Himalayan Aid Society (TRAS).

Read more about Alan here

Please contact TRAS for a free copy of the Tibetans in Exile: The Dalai Lama & The Woodcocks

Email: info@tras.ca